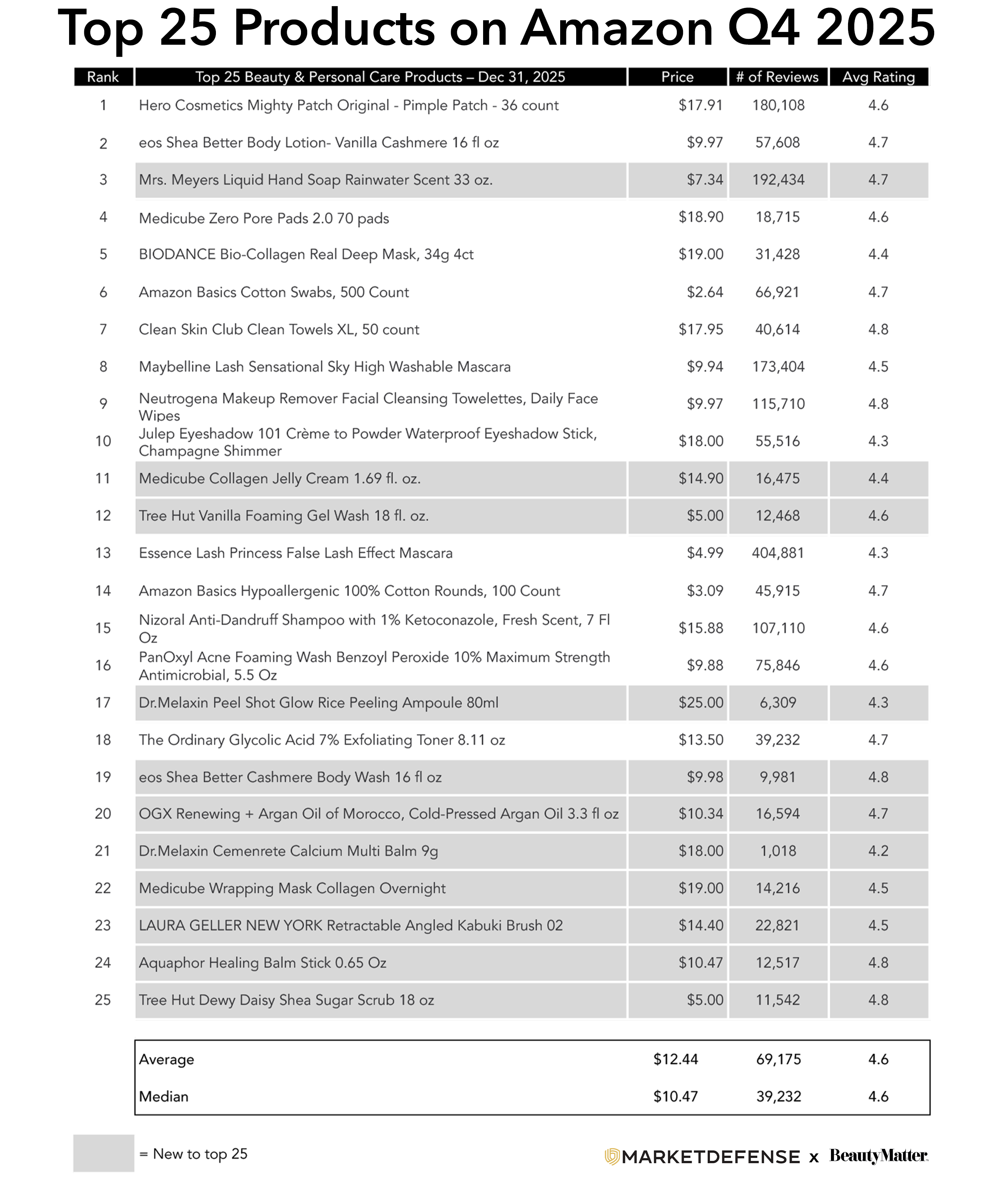

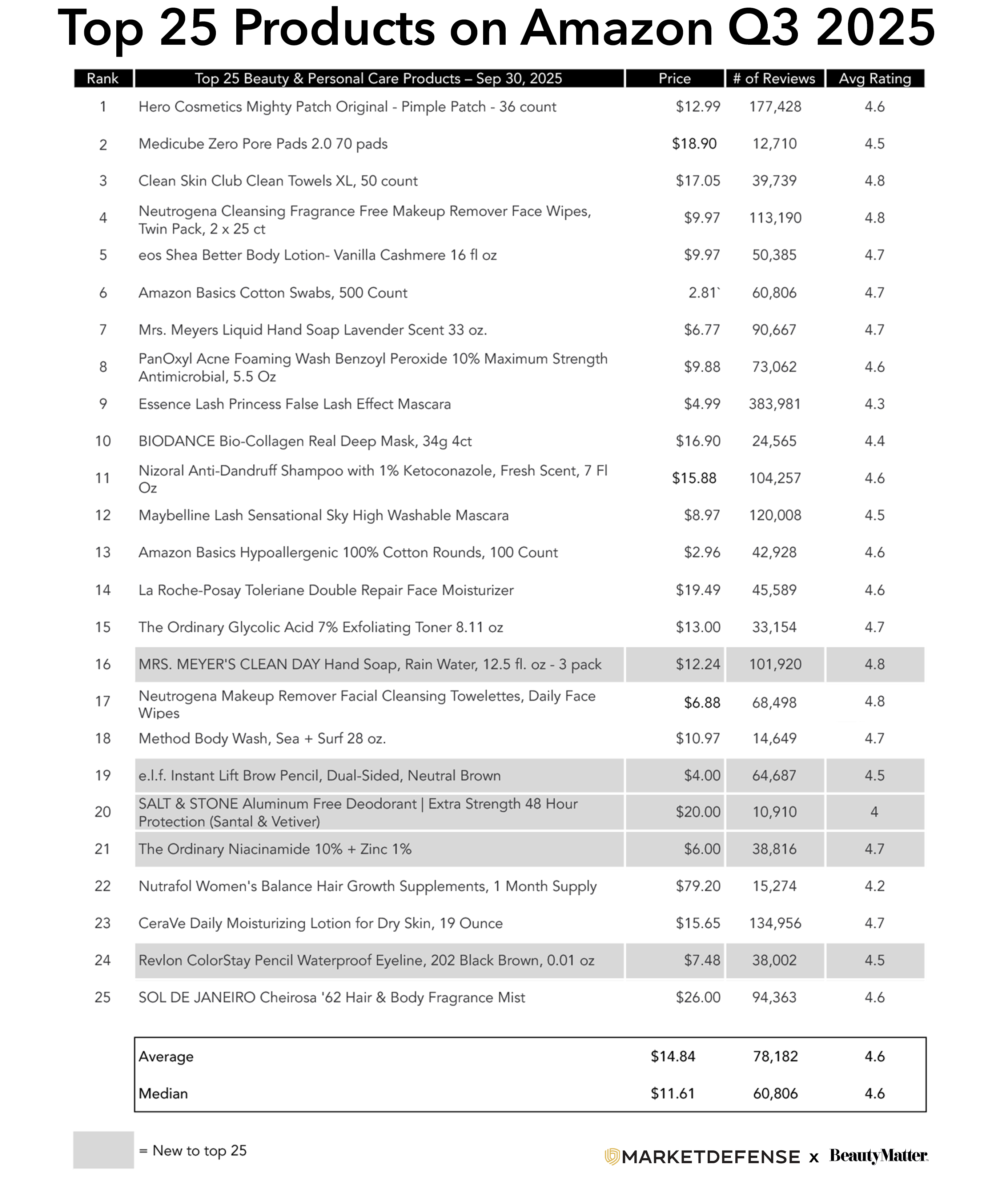

The Top 25 Beauty & Personal Care products for Q4 2025 reflect a market that continues to prioritize routine over novelty. The average price of a Top 25 product fell to $12.44, down from $14.84 in Q3, while the median dropped to $10.47, signaling ongoing price compression and a clear shift toward everyday, replenishable essentials.

The top of the list remains anchored by familiar staples. Hero Cosmetics’ Mighty Patch held the #1 position for another quarter, even as its price climbed to $17.91. eos Shea Better Body Lotion (in Vanilla Cashmere) moved up from #5 in Q3 to #2, while Mrs. Meyer’s Liquid Hand Soap rose to #3, reinforcing the continued strength of functional, repeat-purchase categories. Together, acne care, bodycare, and hand soap define a Top 3 built on consistency rather than experimentation.

The Skincare Top 10

The average price point of the Skincare Top 10 was $13.08, down 4.6% from last quarter.

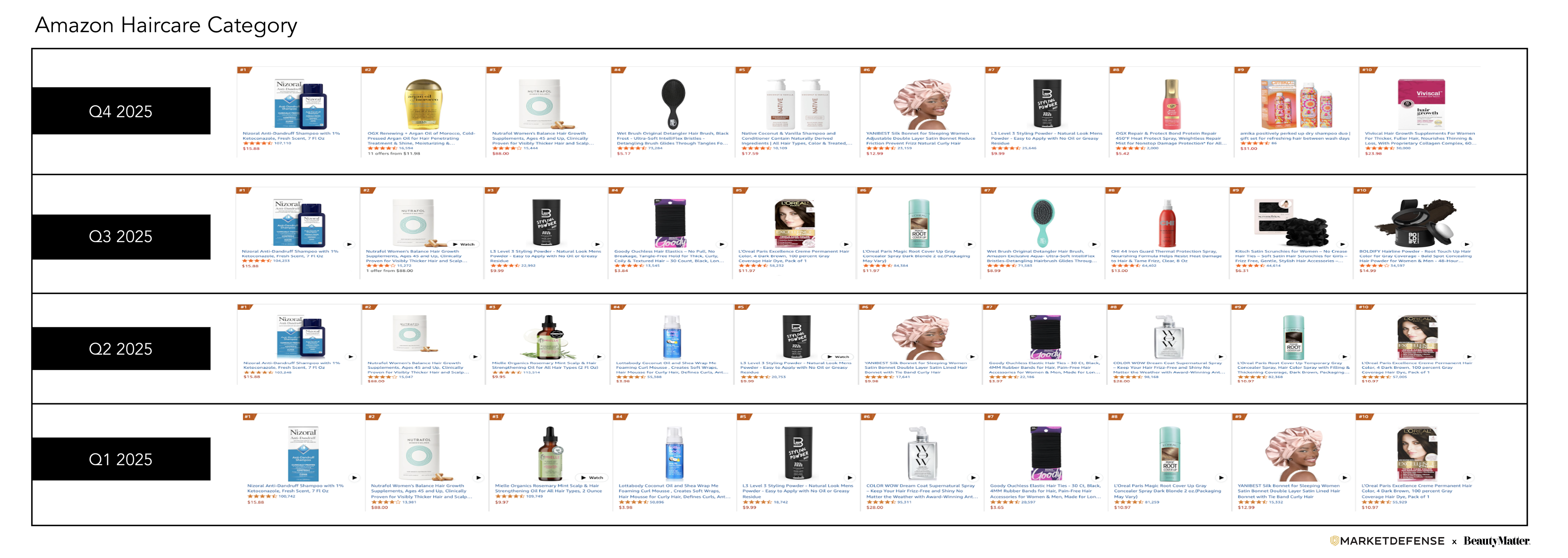

The Haircare Top 10

The average price point of the Haircare Top 10 was $22.20, up 20.0% from last quarter. The driver of this increase was the addition of several higher-priced items into the Top 10, including Amika Positively Perked Up Dry Shampoo Duo ($31.00) and Viviscal Hair Growth Supplements for Women ($23.98).

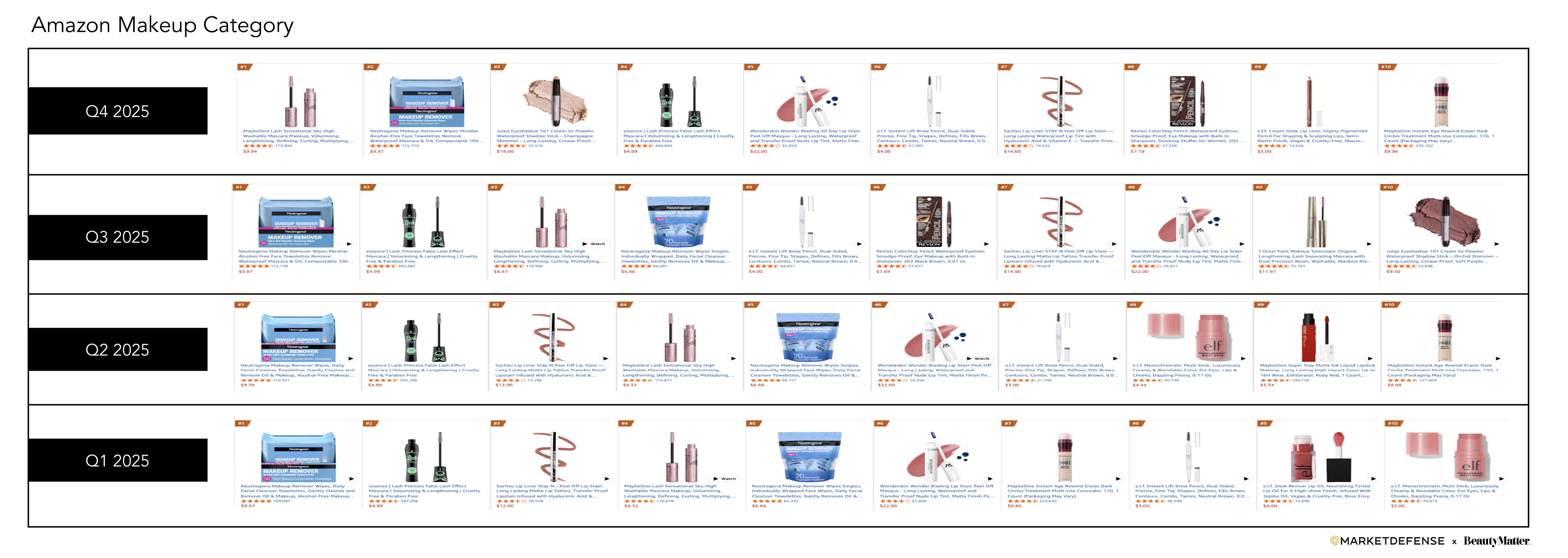

The Makeup Top 10

The average price point of the Makeup Top 10 was $10.31, up 3.1% from last quarter.

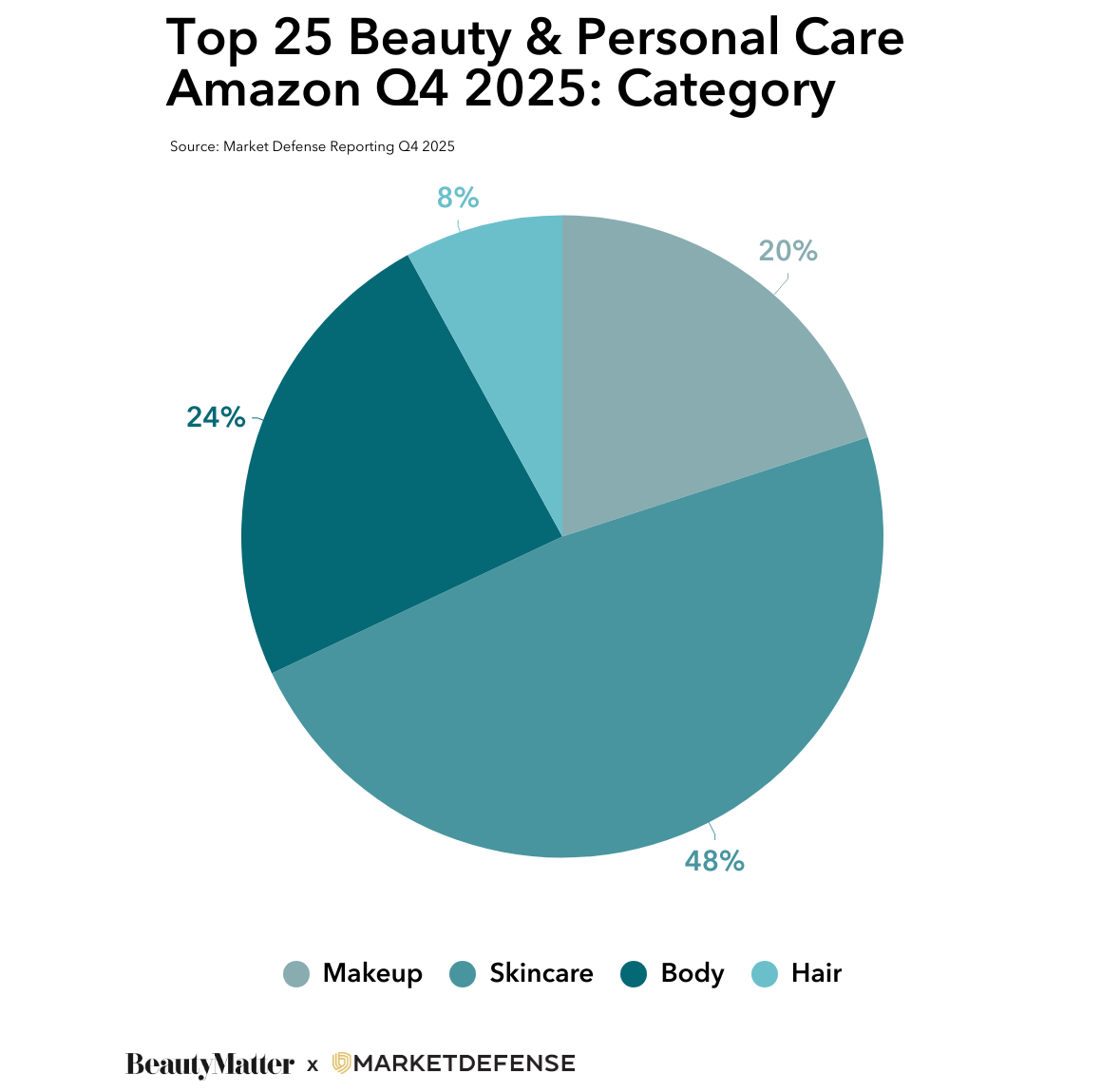

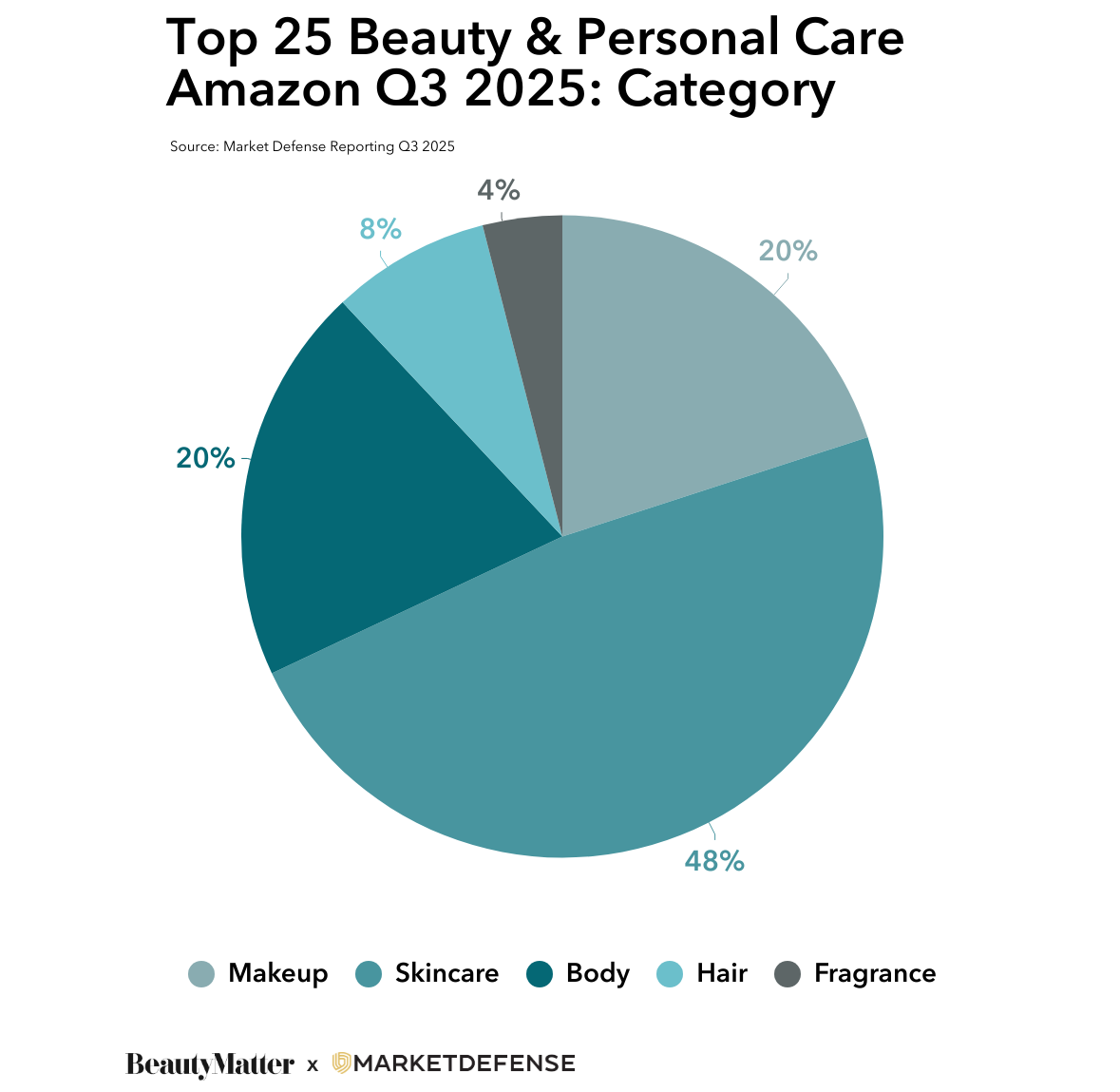

Skincare continues to dominate the list overall, accounting for nearly half of the Top 25. Makeup maintained a steady presence without meaningful expansion, while haircare remained limited to a small number of utilitarian products. The result is a Top 25 that skews decisively toward routines that consumers can maintain daily, rather than trend-driven splurges.

“Amazon’s current algorithm is moving away from rewarding pure sales spikes and is aggressively prioritizing products with high repeat purchase rates, high-frequency replenishment, and products that anchor routines,” says Dave Karlsven, SVP of Data Science & Advertising at Market Defense. “If a product like Mrs. Meyer’s creates a Subscribe & Save rate north of 15%, the algorithm essentially gives it priority placements at the top of the page for the best keywords. The product doesn’t have to fight as hard for visibility and starts owning the category because Amazon knows that customers are very likely to come back and purchase again next month. High-frequency replenishment is the ultimate SEO moat.”

Movement Within the List

Several products posted notable upward movement quarter over quarter. The Biodance Bio-Collagen Real Deep Mask climbed from #10 in Q3 to #5 in Q4, supported by steady review growth and sustained interest in collagen-focused skincare. Maybelline’s Lash Sensational Sky High Washable Mascara moved into the top 10, eos’ Shea Better Body Lotion moved from #5 to #2, and Neutrogena’s Makeup Remover Facial Cleansing Towelettes moved from #17 to #9.

At the same time, the list saw a reshuffling within familiar brands rather than a wholesale turnover. Medicube’s Zero Pore Pads slipped slightly from #2 to #4 but remained firmly positioned near the top, while Clean Skin Club’s Clean Towels held strong in the top 10.

New to the Top 25: Low-Friction Trial Products

Q4 introduced a handful of new entrants that share a common thread: accessibility. Products like Tree Hut Vanilla Foaming Gel Wash, OGX’s Argan Oil, and Aquaphor Healing Balm Stick entered the list at lower price points and with clear, functional value propositions.

“Circana reports that travel-size makeup is up 57% year over year, with four in 10 fragrance shoppers planning to trade up to full size after trying a mini,” says Vanessa Kuykendall, Chief Engagement Officer at Market Defense. “That same trial-first mindset is clearly shaping what’s rising on Amazon, especially in bodycare and treatment-oriented skincare, where low-commitment formats make it easier for consumers to experiment and build routines.”

More notable, however, were the new skincare entrants from Dr. Melaxin, a Korean brand that placed two SKUs in the Top 25 despite relatively low review counts and minimal US retail presence. Those placements foreshadow the larger story of the quarter.

K-Beauty: From Trend Cycle to Category Behavior

While routine products dominate the surface of the Q4 Top 25, the deeper narrative belongs to K-beauty, and how social-first education has reshaped how these brands scale in the US.

According to an October 2025 NIQ report, K-beauty sales in the US reached $2 billion, up 37% year over year, with 70% of those sales now happening online. Once treated as a trend defined by novelty and packaging, K-beauty has materially changed consumer behavior, normalizing double cleansing, multistep routines, ingredient literacy, and skin finishes focused on hydration and glass skin.

Social platforms have played a central role in that shift. On TikTok, more than 740,000 new short-form videos were created around K-beauty in Q3, a 97% increase quarter over quarter, driving billions of impressions across hashtags like #KoreanSkincare, #SkincareRoutine, and #KBeauty. As a result, consumers are increasingly arriving on marketplaces like Amazon with a clear understanding of ingredients, formats, and sequencing; they are not browsing blindly, but shopping with intent.

Medicube: Building Infrastructure, Not Just Virality

That dynamic is most clearly reflected in Medicube’s Q4 performance. The brand placed three SKUs in the Top 25 this quarter: Zero Pore Pads (#4), Collagen Jelly Cream (#11), and Wrapping Mask Collagen Overnight (#22), spanning multiple price points and use cases.

This is no longer a single hero product story. Medicube has built a system that supports routine-based usage, and its Amazon performance reflects that durability. The brand’s momentum is reinforced by strong off-platform demand: Medicube’s Booster Pro device sold more than 18,000 units on TikTok in November, and in 2025 the brand expanded into Ulta Beauty, marking a transition from digital-first scale to selective retail validation.

“K-beauty used to be treated as a trend cycle, but it’s now a category that’s changed how consumers approach skincare altogether,” says Kuykendall. “Social-first education has created a more informed shopper, and Amazon has become the primary place where that education converts. Retail is no longer required to prove relevance; for brands with a strong awareness strategy, it’s something they can add once scale is already established.”

Dr. Melaxin: Early Stage, Algorithmically Validated

If Medicube represents maturity, Dr. Melaxin illustrates what early-stage validation now looks like on Amazon. The brand entered the Q4 Top 25 with two products, Peel Shot Glow Rice Peeling Ampoule (#17) and Cemenrete Calcium Multi Balm (#21), both with comparatively low review counts.

Historically, that would have limited visibility. Today, it signals something different: high-intent traffic driven by ingredient familiarity and routine-based education. Amazon’s algorithm is increasingly surfacing brands earlier in their lifecycle, when shoppers arrive informed and ready to convert rather than waiting for years of review accumulation.

“We are seeing a massive shift in how the A10 algorithm weighs trust signals. Historically, you needed a ‘review moat’ of hundreds or even thousands of 4- and 5-star ratings to rank,” says Karlsven. “Today, 'sales velocity’ driven from external traffic is the new currency. If a brand drives high-converting brand search traffic and sales on Amazon from a TikTok influencer campaign that converts at 12%-15% (double the category average of non-brand search traffic), then Amazon validates and prioritizes that product almost instantly in the algorithm, without the need for years of review accumulation. The algorithm is effectively saying, ‘The market has already validated this off-platform; we will prioritize it on-platform immediately.’ Brands with a large volume of high-converting brand search traffic on Amazon are rewarded heavily in the algorithm across the best Paid and Organic placements on the top searched keywords.”

The Takeaway

The Q4 2025 Top 25 underscores a shift that has been building for several years. Beauty on Amazon is no longer defined by impulse trends or novelty launches. Instead, it rewards brands that fit into repeatable routines and those that leverage social-first education to shape how consumers learn, evaluate, and ultimately, buy.

For K-beauty brands like Medicube and Dr. Melaxin, that shift has unlocked a new path to scale: one where Amazon functions as the primary growth engine, and retail becomes an extension, not a prerequisite.

“The most profitable beauty brands on Amazon aren’t just selling a hero SKU; they are engineering a customer journey from discovery to purchase, both on and off Amazon, that maximizes the average order value and the repeat purchase, lifetime value of the customer,” says Karlsven. “When a customer buys a Medicube device, the algorithm’s ‘frequently bought together’ engine immediately suggests the booster gel and the after-care cream because the brand has been ‘training’ the algorithm in their marketing and content optimizations both on and off Amazon to influence the customer to look for multiple items that are a natural fit to be purchased together. This adjacent-product halo allows brands to draft off their own traffic, lowering their Cost Per Acquisition [CPA] by up to 30% while simultaneously telling Amazon’s algorithm that these products belong together as part of a kit that supports a routine the customer has. You aren't just winning a one-time purchase of a single product; instead you are teaching the algorithm to bundle your catalog for you and give more visibility to your other products that are a good fit for maximizing the value of the customer,” concluded Karlsven.

Previous Reports:

Q3 2025 Amazon Top 25 Beauty & Personal Care

Q2 2025 Amazon Top 25 Beauty & Personal Care

Q1 2025 Amazon Top 25 Beauty & Personal Care